If you’re thinking about building a home, you’ll need the right type of financing to make it happen, and a standard mortgage won’t cover it. Construction loans work differently, and understanding how they’re structured can save you time, money, and stress down the line.

At Hafsa Building Group, we’ve helped clients get started with clear plans and the confidence that every step is handled with care. Since 2017, our team, led by Rami Hafsa, has built homes that reflect exactly what each client wants, with a focus on quality and honest communication from start to finish.

Key Takeaways

- Construction loans finance new builds or major renovations, not the purchase of existing homes.

- Funds are disbursed in stages (called draws) as construction progresses and milestones are met.

- There are four main types of construction loans, each suited to different goals and borrower roles.

- These loans require strong credit, a large down payment, and can come with risks like delays and cost overruns.

What Is a Construction Loan?

A construction loan is a short-term loan that helps you pay for building a new home or doing major renovations.

It’s not for buying a house that’s already built. Instead, it’s for covering the cost of materials, labor, permits, and everything else that goes into the construction process.

Based on data from the Federal Reserve, the average loan-to-completed-value (CLTV) for these loans is about 75.36%, and the average borrower credit score is 712.5, reflecting the higher standards lenders require for this type of financing. Origination fees typically average 0.2% of the original loan amount, according to industry reports.

Here’s how the loan works in simple terms:

- You don’t get the full loan amount all at once.

- The bank gives money in stages, called “draws,” based on how much progress has been made.

- You usually only pay interest during the construction phase.

- Once construction is done, the loan often turns into a regular mortgage.

How Long Do Construction Loans Last?

Most construction loans run for 12 to 18 months, but the average term for residential construction loans is specifically 13.68 months.

During that time, you’ll typically make interest-only payments based on the money you’ve used, not the total loan amount. This structure helps keep monthly costs lower while the house is still being built.

How Do Construction Loans Work?

Construction loans don’t operate like the typical home loan, where you get one big lump sum. Instead, they follow a system that’s built around the construction timeline. You borrow only what you need, when you need it, based on how much progress has been made on your home.

The Draw Schedule Explained

Lenders release funds in phases called “draws.” These are tied to specific stages of the build, like pouring the foundation, framing the walls, or putting on the roof.

Here’s a common example of a draw schedule:

- Draw 1: Land purchase or lot preparation

- Draw 2: Foundation and groundwork

- Draw 3: Framing and roof installation

- Draw 4: Plumbing, electrical, HVAC

- Draw 5: Interior finishes

- Final Draw: Final inspection and project completion

Before each draw is approved, the lender usually sends out an inspector to confirm the work is actually done.

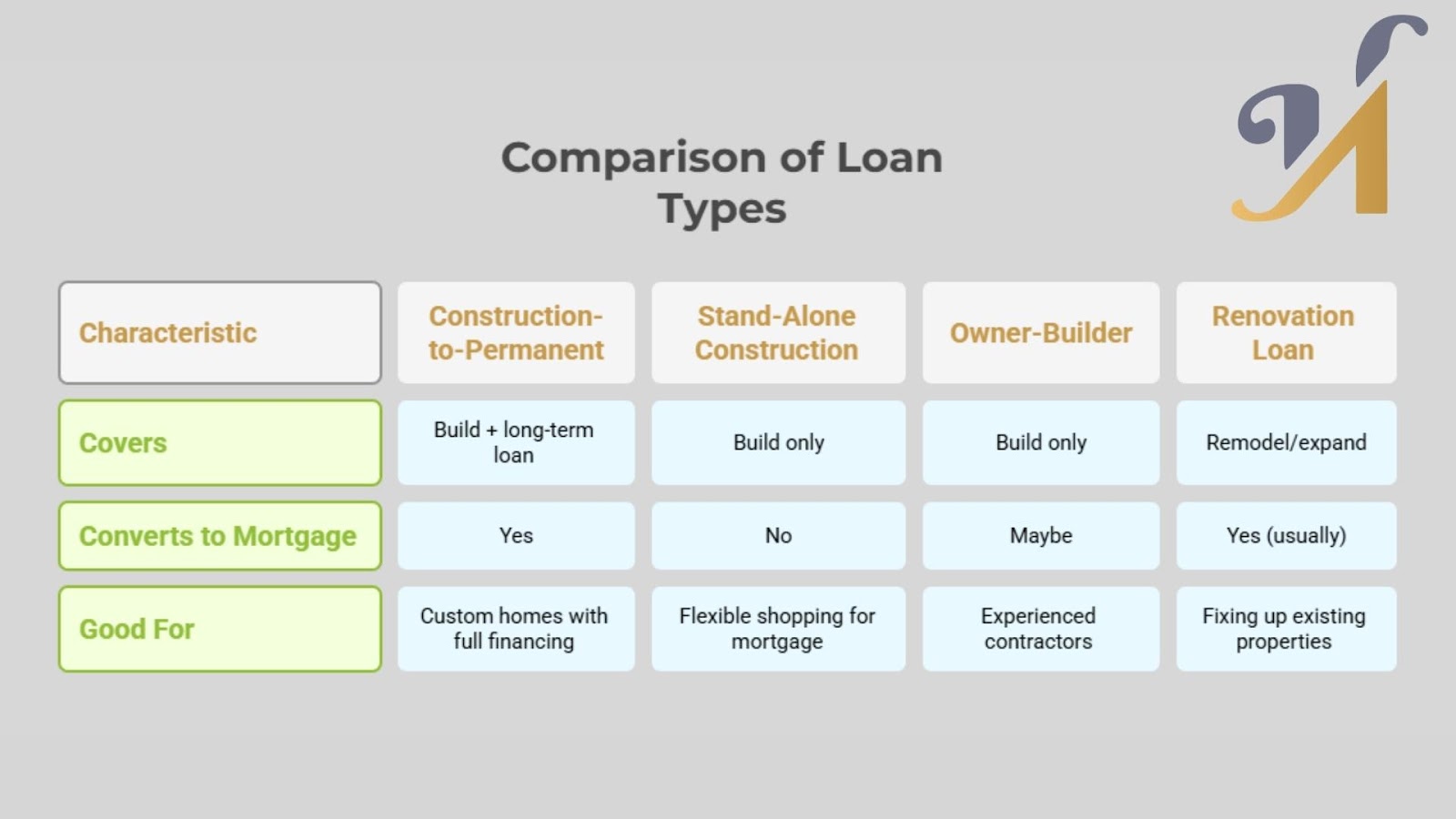

4 Types of Construction Loans

Not all construction loans are the same. The most common types include construction-to-permanent loans, stand-alone construction loans, owner-builder loans, and renovation loans. Each type offers different advantages depending on your goals and level of involvement.

1. Construction-to-Permanent Loans

This is the most common choice for people building a custom home. You borrow once, and the loan automatically switches into a regular mortgage when construction is finished. It’s simple and cost-effective because you only go through the closing process one time.

2. Stand-Alone Construction Loans

This option covers just the construction period. Once the house is built, you’ll need to apply for a separate mortgage to pay off the balance.

It’s a little more complicated and often more expensive in the long run since you go through two closings and may face different interest rates when refinancing.

3. Owner-Builder Loans

If you plan to act as your own general contractor, this is the path lenders will expect you to take. That also means they’ll expect you to have a construction background, licensing, or a detailed project plan.

It’s harder to qualify for these, but possible if you’ve got building experience and can prove you can manage timelines and budgets.

4. Renovation Construction Loans

These are for large-scale home improvements, like gut renovations or major additions. Instead of buying a new place or starting from scratch, you borrow money to upgrade what you already have.

They’re popular among homeowners who want to stay put but need more space, better features, or serious repairs.

Who Should Consider a Construction Loan?

A construction loan makes sense if you’re building a home from scratch, doing a major renovation, or adding square footage to your current house. It’s not for buying move-in-ready homes, it’s for people who want something custom or heavily upgraded.

You’re a good fit if:

- You already own land or plan to buy a lot.

- You want full control over layout, materials, and design.

- You have a detailed building plan and a licensed contractor.

- You can make a down payment (often 20% or more).

- Your income and credit are strong enough to handle the higher upfront costs and interest-only payments.

7 Steps to Apply for a Construction Loan

Getting a construction loan takes more prep work than a regular mortgage. The process involves several steps, including choosing a lender, getting preapproved, and submitting detailed construction plans.

1. Choose a Lender Who Offers Construction Loans

Not all banks offer construction loans. Look for one with experience in construction financing. It helps if they have in-house professionals who understand the building process.

2. Get Pre Approved

This step gives you a rough idea of how much you can borrow. The lender will check your credit, income, debt, and savings, just like they would for a traditional home loan.

3. Submit Your Construction Plans

You’ll need to provide:

- A signed contract with your builder

- Detailed blueprints or architectural plans

- A complete budget (called a “cost breakdown”)

- A draw schedule showing when the builder will request payments

4. The Lender Reviews Your Plans

They’ll order an appraisal based on the future value of your home and assess your builder’s qualifications. This part can take time, especially if anything’s unclear or missing.

5. Final Approval and Closing

Once everything checks out, you’ll sign the loan documents and pay closing costs. The loan officially starts, and funds will be disbursed as construction progresses.

6. The Builder Starts Work and Requests the Drawings

At each stage of the build, the contractor submits a request for payment. The bank usually sends an inspector to verify the work before releasing funds.

7. Project Completion and Loan Conversion

When the house is finished, the lender will either:

- Convert the loan to a permanent mortgage automatically (if it’s a construction-to-permanent loan), or

- Require you to refinance into a new mortgage (if it’s a stand-alone construction loan)

4 Construction Loan Risks and How to Manage Them

Construction loans offer flexibility but come with risks. According to Propeller in 2023, 9 out of 10 construction projects experienced cost overruns, and the cost of slow payments reached $273 billion in 2023, nearly 14% of total U.S. construction costs.

1. Project Delays

Delays like bad weather, labor shortages, permit holdups happen. And with construction loans, time really is money. The longer your project takes, the more interest you’ll pay during the build.

How to manage it:

- Choose an experienced, licensed builder with a strong track record.

- Build a buffer into your timeline and budget.

- Stay involved and keep communication open.

2. Going Over Budget

Prices for materials or labor can change. Sometimes unexpected issues come up that weren’t part of the original plan.

How to manage it:

- Get detailed cost estimates up front.

- Ask your builder to include a contingency fund in the budget.

- Only approve change orders you’ve reviewed in full.

3. Builder Problems

If your contractor doesn’t meet deadlines, goes out of business, or does poor-quality work, you’re stuck with a half-finished home and a big loan.

How to manage it:

- Check reviews, licenses, and past work before hiring.

- Make sure the builder is insured and bonded.

- Use a lender who monitors progress before each draw.

4. Interest Rate Changes

Construction loans often have variable interest rates. If rates go up during your build, your payments can get more expensive.

How to manage it:

- Ask if your lender offers a rate lock or interest cap.

- Consider a construction-to-permanent loan to secure a fixed rate for the mortgage phase.

Frequently Asked Questions

Q: Can I use a construction loan for renovations?

Yes, but only for major projects like structural changes or full remodels, not small upgrades.

Q: Do I need a large down payment?

Usually 20% or more. Some lenders offer lower options, but they’re harder to qualify for.

Q: What if construction takes longer than planned?

You may need an extension or pay extra fees. Delays can also increase interest costs.

Q: Are construction loans harder to get?

Yes. You’ll need strong credit, solid income, and a licensed builder with a clear plan.

Q: How does the builder get paid?

Through draws, payments are released in stages after inspections confirm progress.

Thinking About Building? Start with the Right Team and the Right Loan

Understanding how construction loans work is the first step. Having a builder who communicates clearly and delivers quality from start to finish makes all the difference. At Hafsa Building Group, we treat every project like it’s our own, carefully planned, built to last, and tailored to your vision.

If you’re ready to move forward or want to talk through your options, visit our contact page to get in touch. Let’s bring your plans to life, one step at a time.