Buying land in 2025 comes with new financial realities and stricter zoning requirements compared to just a few years ago. With U.S. farmland prices averaging $4,080 per acre in 2024 (USDA) and suburban plots in states like Florida and Texas climbing steadily, understanding the step-by-step process is critical before you make an offer. This guide covers everything from budgeting and zoning laws to financing options, backed by real data and our experience at Hafsa Building Group helping families turn vacant lots into homes since 2017.

Key Takeaways

- Land is still more affordable than homes in 2025, USDA data shows the average acre costs $4,080 nationwide, with Texas rural land around $7,500 and suburban Florida closer to $15,000.

- Zoning laws are make-or-break, always confirm whether your land is approved for residential, agricultural, or commercial use before you buy.

- Due diligence prevents surprises, surveys, soil tests, flood zone checks, and utility access must be confirmed before closing.

- Hidden costs can double your budget, permits, septic, wells, and road access often add $10,000–$40,000 beyond the purchase price.

Is Buying Land in 2025 a Good Idea?

Yes. Land is still affordable in many areas, especially compared to housing. You can build what you want, on your own timeline, without dealing with outdated homes or HOA rules.

Top 3 Reasons to Buy Land in 2025

- More control – Build what you want, when you’re ready

- Lower cost – Land is often cheaper than homes

- Long-term value – Good land tends to appreciate

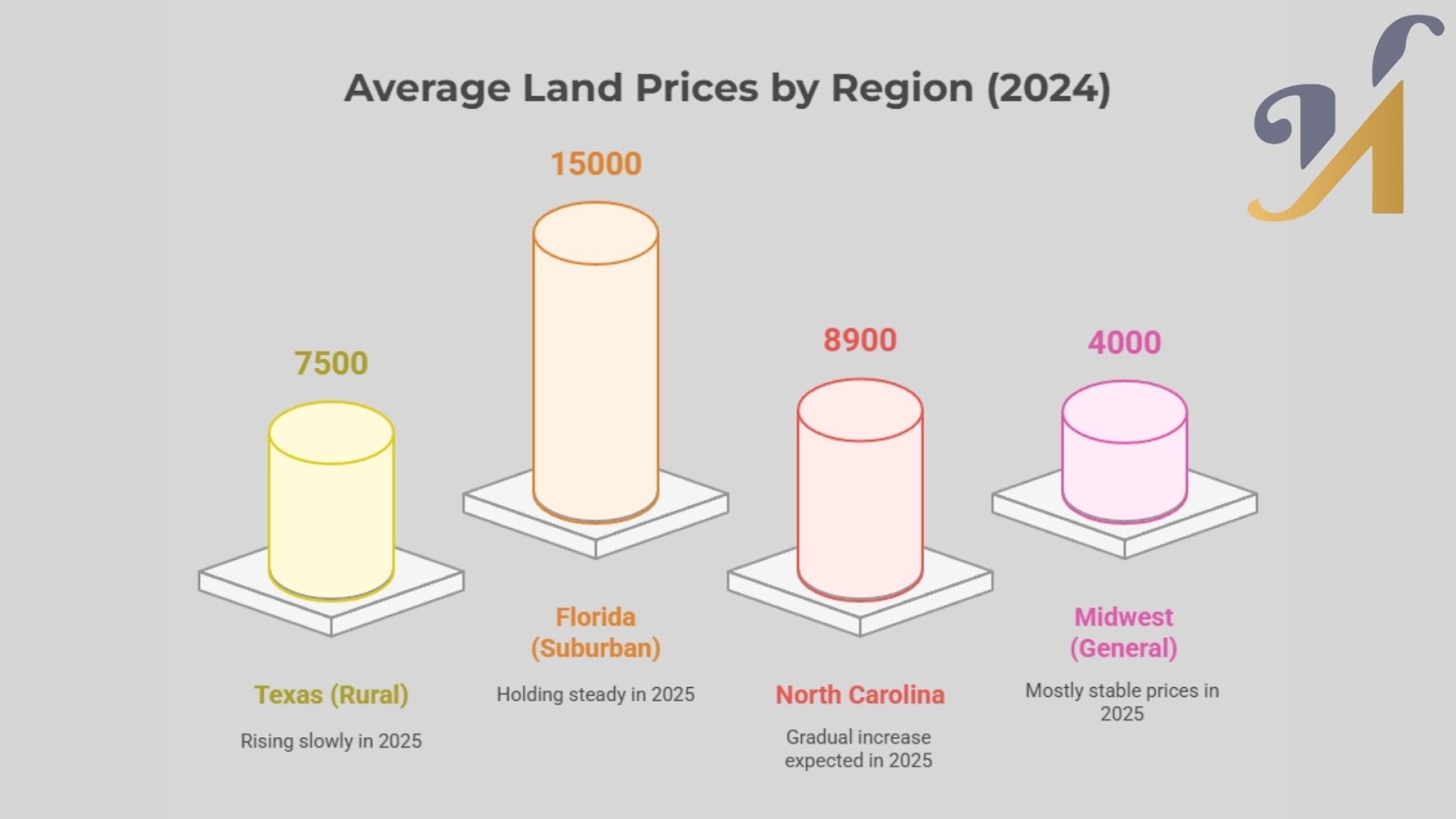

Where Land Prices Are Going

| Region | Avg. Price (Per Acre, 2024) | 2025 Outlook |

| Texas (Rural) | $7,500 | Rising slowly |

| Florida (Suburban) | $15,000 | Holding steady |

| North Carolina | $8,900 | Gradual increase |

| Midwest (General) | $4,000 | Mostly stable |

How Do You Buy Land Step by Step?

Here’s a step-by-step breakdown for buying land:

1. Set Your Budget and Goals

Decide what you’re using the land for, such as, building a home, farming, or investing. Then figure out how much you can spend, including closing costs, surveys, and possible site work.

2. Find Land for Sale

Check sites like Zillow, LandWatch, or work with a local agent. Visit the land in person. Look at access, surroundings, and basic features like slope or tree cover.

3. Check Zoning and Restrictions

Call the county zoning office. Ask what structures are allowed on the land like, residential, agricultural, commercial. Zoning decides whether you can build at all.

4. Do Your Due Diligence

Before you buy:

- Get a land survey

- Test the oil if you need septic

- Check for utilities: water, electricity, internet

- Look for flood zones or easements

5. Choose Financing

Land loans work differently from home loans. Options include:

- Bank land loans – may require 20–50% down

- USDA loans – for rural areas (if you qualify)

- Seller financing – if the owner offers terms

Use a land loan calculator to check monthly payments.

6. Close the Deal

Review the title, sign the contract, and transfer funds, and attain title insurance. Though optional, a real estate agent/attorney can assist with these matters.

What Are the Costs Involved in Buying Land?

The land price is just the start. You’ll need to budget for both upfront and long-term costs.

Upfront Costs

- Land price – Varies by size, location, and zoning

- Survey – $500–$1,500

- Appraisal – $300–$800 (if financing)

- Closing costs – Title search, legal fees, escrow: $1,000–$3,000

- Down payment – Often 20%–50% if getting a land loan

Ongoing and Hidden Costs

- Property taxes – Depends on location and land use

- Insurance – Land liability or builder’s risk insurance if you start construction

- Utilities – Adding water, power, or septic can cost $5,000–$30,000+

- Zoning and permit fees – $500–$3,000 depending on your build

Cost Breakdown Example

| Expense | Estimated Range |

| Survey | $500–$1,500 |

| Septic installation | $3,000–$12,000 |

| Well drilling | $5,000–$15,000 |

| Electric hookup | $1,000–$10,000 |

| Road access (if needed) | $2,000–$20,000+ |

Always inspect the land before buying so you know what infrastructure is missing and what it will cost you later.

What Questions Should You Ask Before Buying Land?

Ask the right questions up front. If you don’t, you could end up with land you can’t use, can’t build on, or can’t afford to develop.

Can I build what I want here?

- What is the zoning?

- Are there any deed restrictions or HOA rules?

- Will I need special permits?

Is the land buildable?

- Is it in a flood zone?

- Is the soil suitable for septic?

- Is the slope or shape a problem for building?

Are utilities available?

- Is there access to water, electricity, or internet?

- Will I need to drill a well or install a septic?

- How far is the nearest power pole?

Does the land have legal access?

- Is there a public or private road leading to it?

- Are there easements or shared driveways?

- Will I need to pay for road maintenance?

Are there any hidden costs?

- Are there unpaid taxes or liens?

- Will the county charge impact fees when I build?

- Is the title clean and transferable?

Found the Perfect Land? Let’s Build Something That Lasts

You’ve got the steps, the questions, and the numbers, now you just need the right team to turn your land into a home that fits your life.

At Hafsa Building Group, we build exactly what you envisioned, with quality you can see in every detail and communication you can count on at every stage. When you’re ready to move from planning to building, we’re here to make it simple and seamless.

Reach out through our contact page to start your build with a team that treats your goals like our own.